W-2 Tax Form Guide

Your Free Guide to the W-2 Tax Form

We are privately owned and not affiliated with the government in any way or form.

Although Tax Day – which falls on or around April 15 each year – marks the deadline to file annual income tax returns, the government requires most employed individuals to make tax payments throughout the year. Employers generally deduct taxes from their employee’s paychecks on their behalf to send to the government. The W-2 – Wage and Tax Statement form is a report of an employee’s annual wages, the amount of withheld taxes, and other financial considerations.

Who Gets a W-2 Wage and Tax Statement

An employee is a worker who receives compensation and benefits but is not an independent contractor. If someone receives wages as an independent contractor or freelancer, the employer does not need to withhold taxes or issue a W-2 form.

You are a W-2 employee if you completed and submitted a W-4 to your employer, usually as part of your new-hire paperwork. The information on your W-4 helps your employer to determine how much taxes to withhold from your paychecks.

You may receive multiple W-2s if:

- u003cspanu003eYou work as an employee for more than one employer. u003c/spanu003e

- u003cspanu003eYou switched jobs during the year. u003c/spanu003e

- u003cspanu003eAnother organization purchased or acquired the company where you work. u003c/spanu003e

You could receive a tax refund after filing your annual income tax return if your employer withheld too much of your paycheck. On the other hand, you would need to pay the difference if your employer did not withhold enough to cover your tax responsibility.

When You’ll Get a Form W-2, Wage and Tax Statement

The government requires nearly all employers to send a copy of the W-2 form to each employee and the Internal Revenue Service (IRS) after the end of the year. The IRS gives employers until January 31st to send these W-2s so that employees have sufficient time to complete and file their taxes before the Tax Day deadline, which occurs in April.

Sections on a W-2

The W-2 Form is organized into different sections. Each section requires you to provide different information about yourself, your employment and your financial situation.

Boxes A through F contain identifying information about you and your employer.

- Box A: your Social Security number (SSN)

- Box B: your employer’s identification number (EIN)

- Box C: your employer’s name and address

- Box D: the number that identifies you in your employer’s records

- Box E: your full legal name

- Box F: your address

Boxes 1 and 2 report your total taxable income from that employer and how much your employer withheld for federal taxes.

- Box 1: your taxable income, wages, tips, bonuses, and other compensation

- Box 2: the amount of federal income tax your employer withheld from Box 1

Boxes 3 through 6 report how much of your earnings are subject to Social Security and Medicare taxes and the amount your employer withheld.

- Box 3: amount of your earnings subject to Social Security taxes

- Box 4: amount of Social Security tax withheld from Box 3

- Box 5: amount of your earnings subject to Medicare taxes

- Box 6: amount of Medicare tax withheld from Box 5

Boxes 7 and 8 report tips you earned or your employer distributed to you, respectively.

- Box 7: amount of tips subject to Social Security taxes

- Box 8: amount of allocated tips, which are not included in Boxes 1, 3, 5 or 7

Boxes 10 through 12 report other types of income, including compensation for childcare, delayed bonuses, 401(k) contributions, group-term life insurance, or a cafeteria plan.

- Box 9: this box is grayed out because the information it once held is no longer relevant.

- Box 10: amount of dependent care benefits, which is included in Box 1 if it is $5,000 or more

- Box 11: amount of nonqualified distribution, which is included in Box 1

- Box 12: amounts of different types of deferred compensation

Boxes 13 and 14 report your employee tax status and other tax-related information.

- Box 13: check boxes for:

- Statutory employee if you are subject to Social Security and Medicare taxes but not income tax

- Retirement plan if you were in your employer’s retirement plan

- Third-party sick pay if you received sick pay from an entity other than your employer that is subject to Social Security and Medicare tax but not included in Box 1

- Box 14: other tax information, such as after-tax retirement plan contributions, employer-paid tuition assistance, and union dues

Boxes 15 through 20 report state and local income tax information for up to two states and two localities.

- Box 15 – your employer’s state ID number

- Box 16 – wages subject to state taxes

- Box 17 – amount of state income tax withheld from Box 16

- Box 18 – wages subject to local taxes

- Box 19 – amount of local income tax withheld from Box 18

- Box 20 – type of local tax in Box 19

How to Use Form W-2 to File Your Federal Tax Return

You will need to transcribe the information on your W-2 onto your individual tax return (Form 1040).

Box 1 of your W-2 is the amount you will need to include on Line 1 of the 1040 form. If you have multiple W-2s, you must add up these wages for the total amount of money you earned from all employers. You should also include any tips or pay you received but did not report to your employer. You may need to add any amounts in boxes 8, 10, and 12.

Box 2 of your W-2 is the amount you will need to include on Line 25a of the 1040 form.

If there is an amount listed in Box 8 of your W-2, you will need to complete Form 4137, Social Security and Medicare Tax on Unreported Tip Income.

If there is an amount listed in Box 10 of your W-2, you will need to complete Form 2441, Child and Dependent Care Expenses.

If Box 13 of your W-2 has a check for ‘Statutory Employee,’ you should use Schedule C of Form 1040 to report your wages.

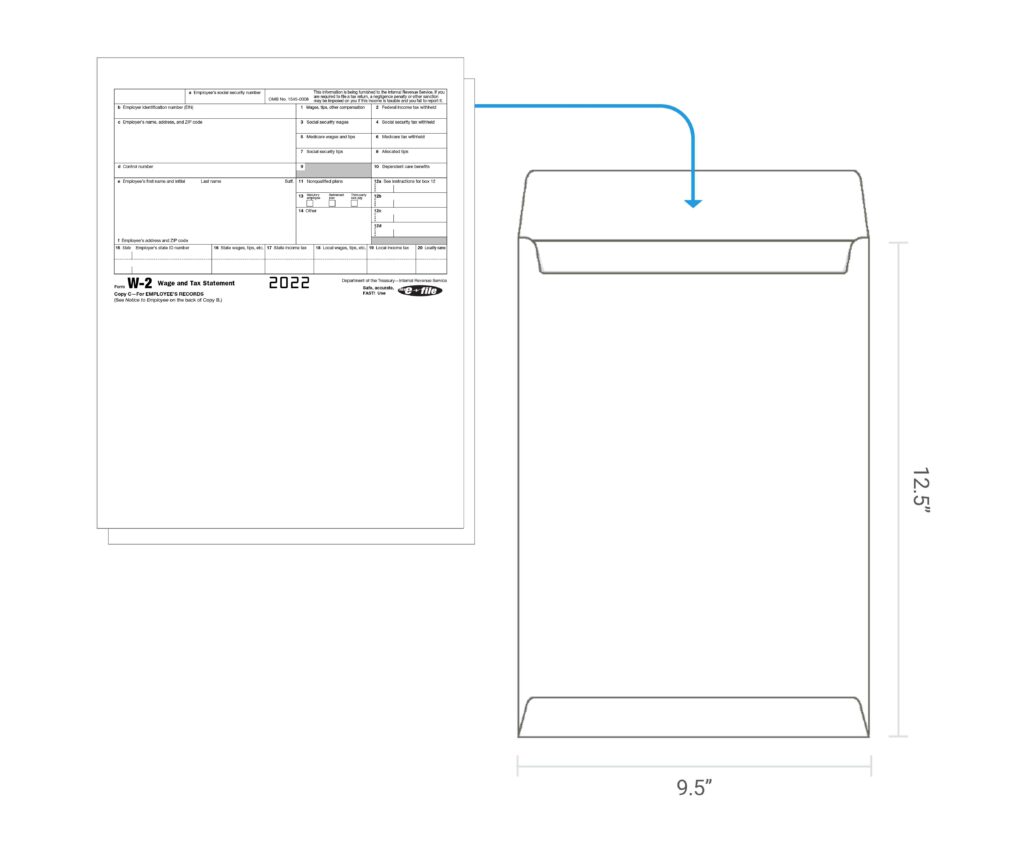

Even though the IRS receives a copy of your W-2 from your employer, you must attach it to your 1040 when you complete your income tax return. This is done to verify the amount of income reported on your W-2.